Nigeria Woos Foreign Investors To Bridge Tomato Production Gap

Stakeholders in the Nigeria tomato industry have agreed to hold annual tomato investment roundtable, as part of the initiative to build –up more investment required to stimulate production active along value- chain in country.

Scaling –up investment in the sector, is believed would go a long way in generating activities that will address the current trend in which over 45 percent of tomato cultivated in the country are lost due to poor post-harvest management.

The stakeholders made this submission at a maiden edition of the Nigeria Tomato Investment Roundtable, held during the week, in the Dutse, capital of Jigawa State.

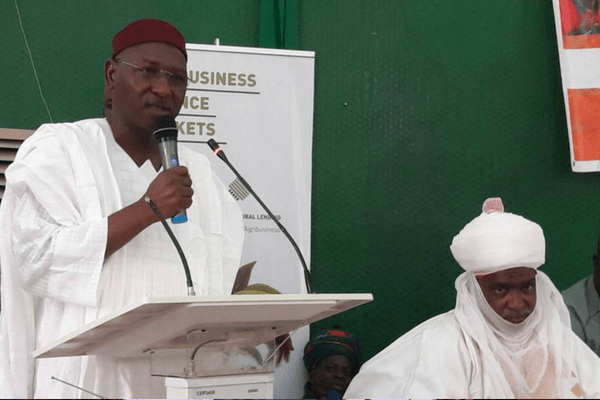

The roundtable which drew participants from within and outside the country, was declared opened by Muhammad Badaru Abubakar, governor of Jigawa state, and also had in attendance, Hafiz Abubakar deputy-governor of Kano state, among others.

Delivering a lead paper, Muhammad Sagagi, a Northern Nigeria based economist recall the growing market for fresh and processed tomato in the country, charging foreign investors to take advantage of the opportunity.

Sagagi, who is the pioneer, director –general of Jigawa State Investment Promotion Agency, disclosed that at the moment the country is able to meet only 1.8 million metric tons out of the about 3.5 million tons total national demand for tomato.

Also See: Crenov8 to Hold Meet The Farmers Satellite Conference in Ghana – #MTFCGHANA2018

He observed that due to various reasons local growers of the commodity are still finding it difficult to bridge the over 500,000 metric production gap currently existing.

“There is growing output gap and market for tomato in the country. At the moment 45 percent of the total output is being wasted due to poor post-harvest management. This wastage provides investment opportunity for willing investors.

“We also have the challenge of value addition, study conducted under GEMS4 activity, points to the fact that Nigeria needs about 124 Tomato Processing facilities across the states where the commodity is cultivated. This is another huge investment gap.

“In the same vein, the nation also have investment opportunity in the distribution area, as well as there are opportunities for commercial banks and financial institutions in area of financing enterprises ready to maximize opportunities in these sub-sectors” he stated.

Sagagi identified lack of competitiveness, poor investment climate, difficulty in sourcing funding, infrastructural constraint, as well as nature of land and agricultural practices, as some of the challenges hampering inflow of investment in the sector.

One of the highlights of the roundtable was a Panel Discussion on Private Engagement in the Tomato Value –Chain, moderated by Richard Ogundele, CEO, JMSF Agribusiness Nigeria.

The discussants drawn from various segment of the tomato value –chain, unanimously agreed that there is the need for the stakeholders to invest building the capacity of small- holder farmers, who are the major producer of the commodity.

The discussants also called on the government at all levels to boost investment in the area of infrastructure that would enable the small farmers to scale –up their production, as well as help organize the farmers into co-operative society.

In his address at the occasion, Tim McClellan, Chief Operating Officer, TechnServe Inc, the company that initiated the roundtable in partnership with Rockfeller Foundation, Syngenta Nigeria, Syngenta Foundation for Sustainable Agriculture based in Kenya, and Pyxera Global, disclosed that his company will continue to work with the partners helping Nigeria meet its agriculture aspiration.

The Nigerian Minister of Agriculture and Rural Development, Audu Ogbeh, as well as Minister of Industry, Trade, and Investment, Okechukwu Enelamah, were represented at the occasion.

Source: Business Day Online

You May Be Interested In:

- Father Godfrey Nzamujo – The Man Behind Songhai Centre

- Brookside to Train Kenya Farmers on Milk Production

- Nigeria Gains $402m From Cashew in 2017

- Farmcrowdy Garners Up To £1,620,000 From Nigerian and Diasporan Investors Into The Agricultural Sector

- GCP21 Wants Africa to Double Cassava Production to Prevent Food Crisis by 2050